Gold Prices Remain Ignored as Uncertainty Increases

Gold prices have declined on fears that we are headed toward a period of high interest rates, since the precious metal isn’t worth holding in those times. Don’t get lured by this idea, whatsoever.

This is what investors need to know: if they are ignoring gold prices, they could be making a grave mistake. The yellow precious metal’s fundamentals are screaming that much higher prices could be ahead, and it’s selling at a severe discount.

Think global when looking at gold prices. Don’t just think of gold prices in U.S. dollars.

Gold, at its very core, is used by investors to hedge uncertainty, and we currently have an abundance of uncertainty across the globe. This could create demand for the precious metal, if that demand hasn’t already been created. It wouldn’t even be shocking to see a shortage of the physical metal in the market.

Let me ask one question.

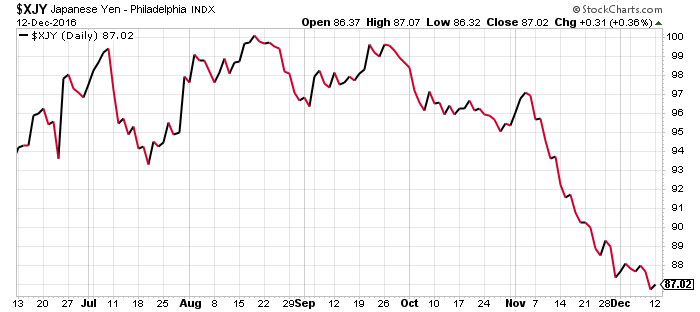

Currently, the Bank of Japan is implementing a negative interest rates policy (NIRP) and printing money to boost the Japanese economy. It’s failing at its goals. As a result of this, the Japanese currency has plummeted severely. Look at the chart below of the Japanese Yen Index.

Chart courtesy of StockCharts.com

In just the past few months, the Japanese currency, compared with other major currencies, has declined well over 10%. If I were to go back further, the decline in the currency is much bigger.

With this, I ask: Won’t investors in Japan look at gold to secure their wealth? It’s possible.

Look at India as well. We are seeing something truly extraordinary. In order to curb corruption in the country, the Indian government has literally banned a few of its most-used currency notes. Don’t for a second think it won’t have consequences on gold prices. Read more here about what’s happening in India: “Gold Prices: This 1 Factor Could Send Gold Prices Soaring in 2017.”

India’s currency note ban could cause a surge in gold demand.

Lastly, you have to pay attention to Britain as well. The British pound has tumbled significantly when compared to other major currencies. And it could fall further. Keep in mind, Brexit is still in play, and we are hearing that negotiations are in process on how this could be done.

What would this do? It would increase the demand for gold. Britain getting out the European Union (EU) is a big deal. Understand that Britain is one of the financial hubs of the global economy, and the Brexit negotiations could spook investors. They could run for safety, and gold provides that.

Don’t Be Shocked if Gold Prices Soar in 2017

The bears are trying very hard, but 2016 looks to be the year that will end on a positive note for gold prices.

Dear reader, I have said it before and I will say it again: gold prices closing higher in 2016 for the first time since 2012 will attract investors who have been on the sidelines and don’t even want to look at the precious metal.

Here’s what I will end on: going into 2017, I am more bullish on gold prices than I was going into 2016. The yellow metal is ignored for all the wrong reasons; its upside potential is immense.